As per RBI guidelines on KYC norms, banks need to periodically update records of customer identification documents. In addition to the KYC carried out at the time of account opening, account holders are required to undergo re-KYC. So, this can be done through net banking or by visiting a branch. We will be discussing multiple methods through which you can easily do so. So, stay with this HDFC KYC Updation Online post till the end to know the details.

When should I update my KYC?

Branch asks its customers to update their KYC from time to time. This can be conveyed when you visit a branch or through email.

Recently, I received an email regarding KYC updates from bank officials. Please see the email I received below.

Update HDFC Registered Mobile Number Online

Can I do it online?

Yes, follow the steps below.

How to Update HDFC KYC 2023?

Method 1: Re-KYC using Aadhaar

So, follow steps:

- To begin, log in to your NetBanking account.

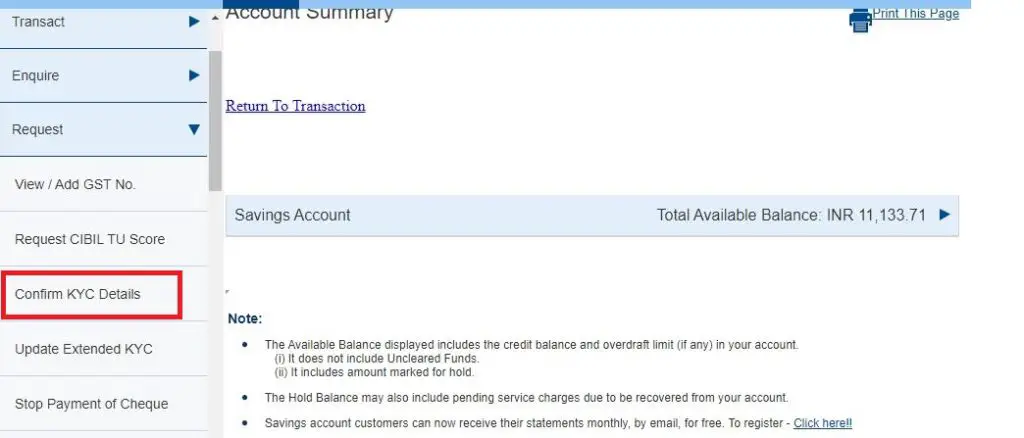

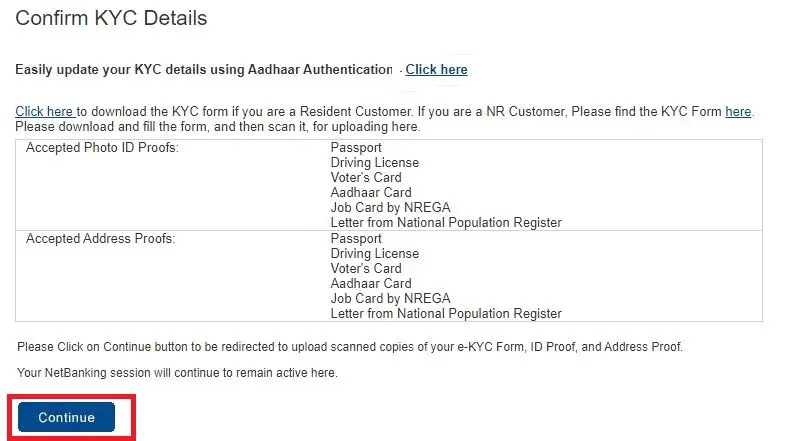

- Once you are in the netbanking dashboard, go to the Request menu on the left side and click on Confirm KYC Details.

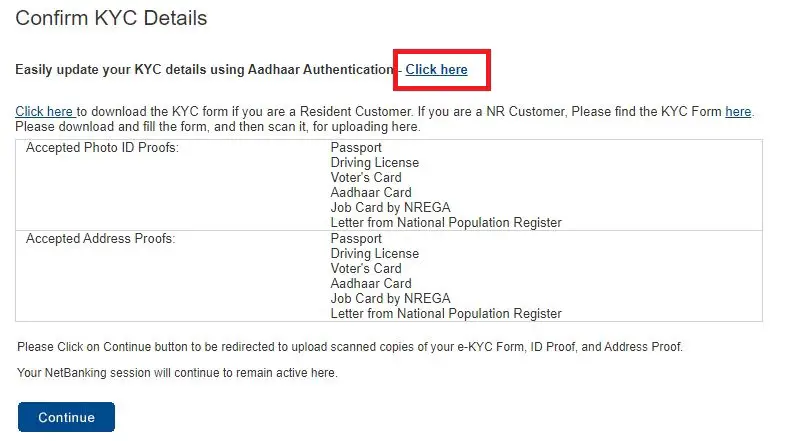

- Click on Easily update your KYC details using Aadhaar Authentication – Click Here link

- Now, login to netbanking using Customer ID, Password/IPIN and click on Login

- Click on Continue to proceed

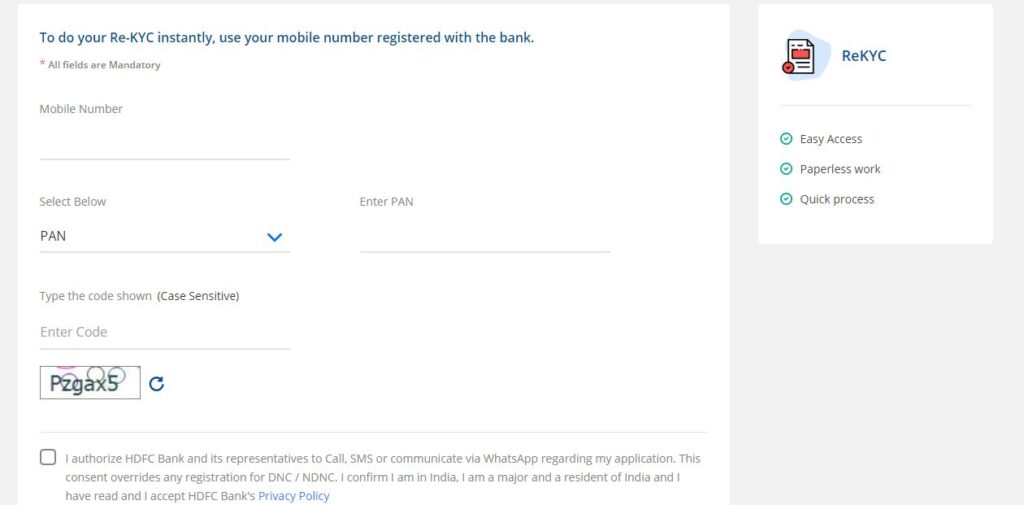

- Next, a small online KYC form will open. Enter your bank’s registered mobile number, PAN, or DOB, check the box, and click on Continue.

- Enter the OTP received on your mobile number and click on Verify & Proceed.

- Enter your Customer ID and click on Continue.

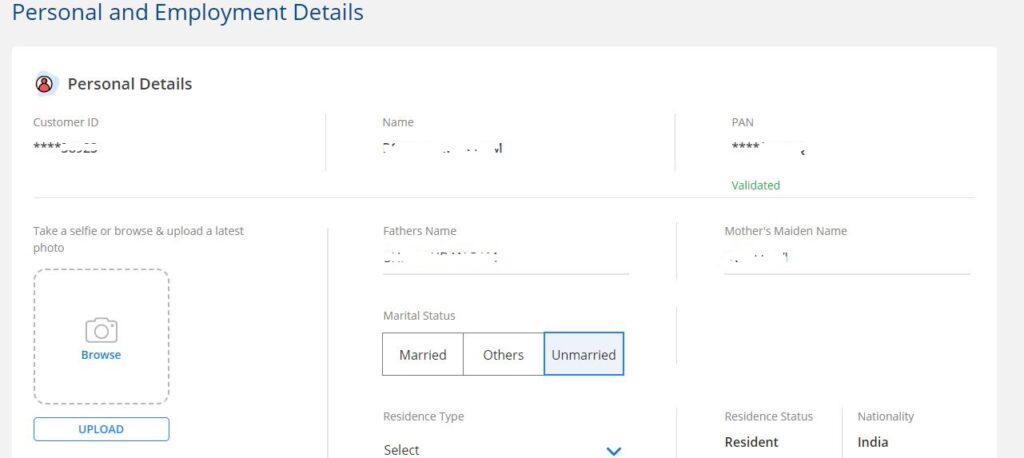

- Now, update or enter incomplete details, upload latest photo or selfie, and click Continue. (Note: You can also take a selfie directly from your camera)

- Next, click on Proceed (Instant address change using Aadhaar), check the box, and click on Proceed.

- Accept the terms by clicking on Agree.

- Check your Aadhaar number and click on Continue. Also, enter the OTP for authentication.

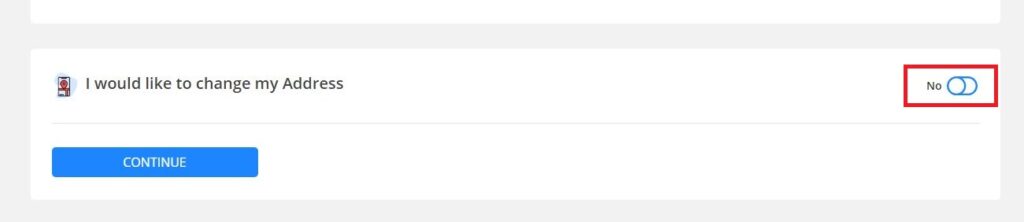

- Now, you can also update the address or keep it as it is and click on Continue. You can also do it from here Change Address in HDFC Bank Online

- Now, check all the details carefully and click on Continue to confirm the entered details.

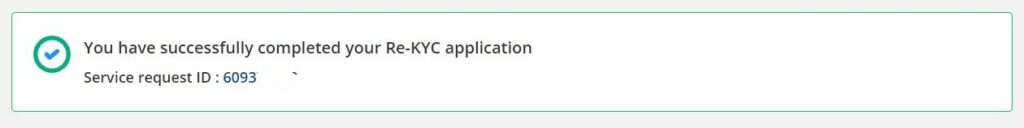

- Finally, you can see a successfully completed message on the screen along with the service request ID. Following the update, you will also receive email and SMS confirmation.

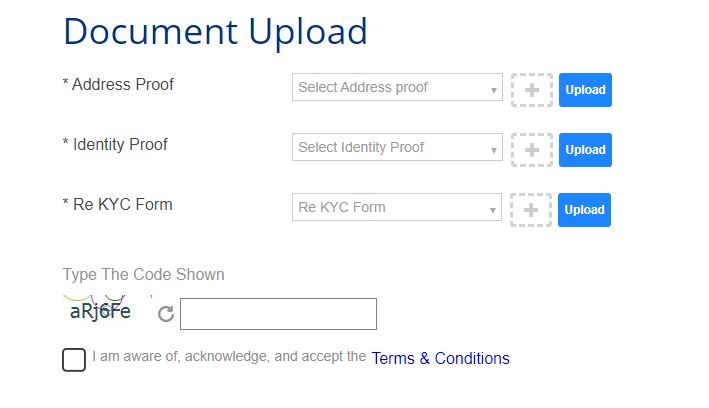

Method 2: Using Online Submission of the KYC Form

You can also fill out the KYC form and upload it only with the required documents.

So, follow the below steps:

- To begin, log in to your NetBanking account.

- Once you are in the netbanking dashboard, go to the Request menu on the left side and click on Confirm KYC Details

- Click on Continue and then confirm the details.

- Now, upload your address proof, identity proof, and Re KYC form before clicking Submit.

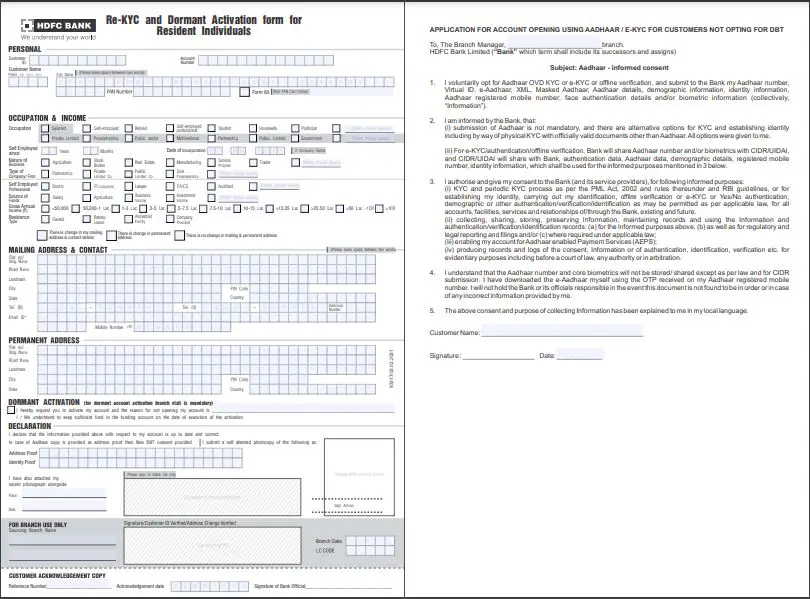

Download the KYC Form: Download the Form

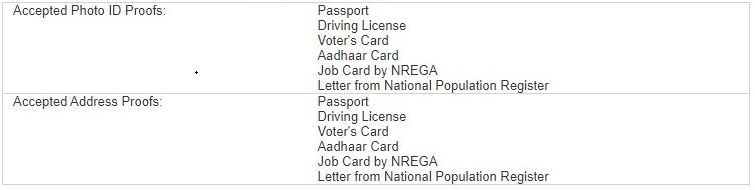

Also attach self attested documents from the below list along with the above-filled KYC.

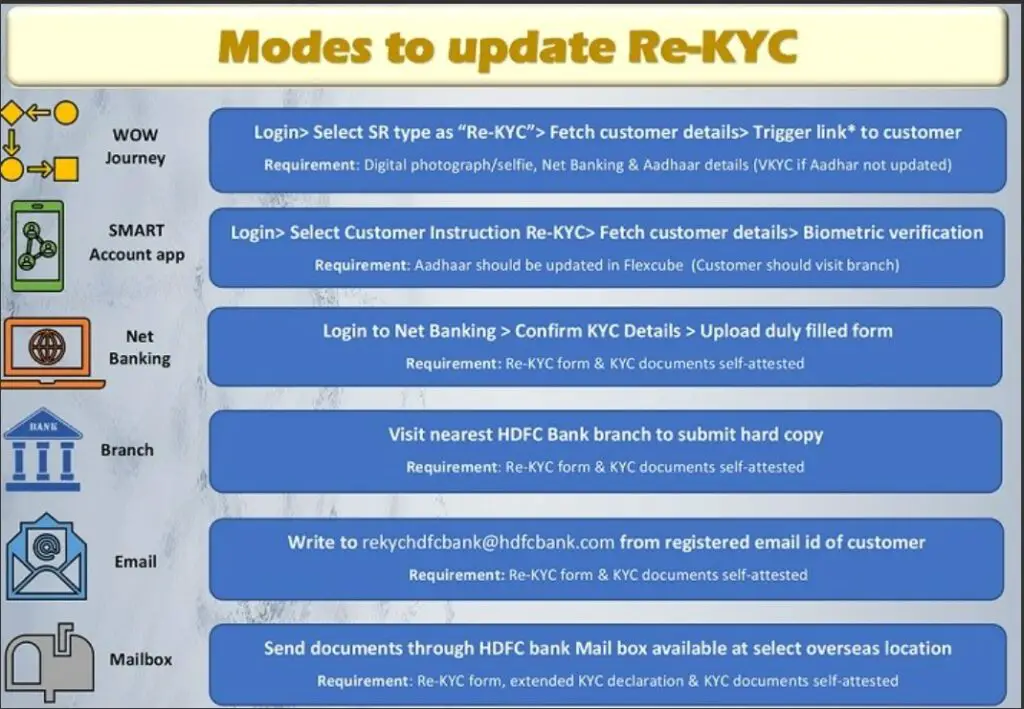

Method 3: Sending an Email

Apart from the above methods, HDFC has made provision for submitting KYC via email as well. You must complete the KYC form, self-attest the documents, and scan them. Attach all the documents and send them from your registered email address.

Email ID: [email protected]

Method 4: Offline Submission of KYC

So, if you don’t use net banking, visit your branch. Submit a hard copy of Re-KYC form along with self-attested documents.

Accepted Documents for KYC

| Accepted Photo ID Proofs: | Passport |

| Driving License | |

| Voter’s Card | |

| Aadhaar Card | |

| Job Card by NREGA | |

| Letter from National Population Register | |

| Accepted Address Proofs: | Passport |

| Driving License | |

| Voter’s Card | |

| Aadhaar Card | |

| Job Card by NREGA | |

| Letter from National Population Register |

How to Add SI in HDFC Bank Online?

KYC Procedure for HDFC NRI Customers

| If you are a NR Customer, please click here to view the list of acceptable address proof documents. |

| For documents in Foreign Language (Language other than English), please upload Non English Language Declaration Form along with the respective document which is in Foreign Language. Kindly click here for the format of the Declaration. |

| Profile updation details (AML) details are mandatory on NRI Re-KYC form. |

| Foreign passport holder need to upload OCI/PIO card or PIO declaration. Kindly click here for the format of the PIO Declaration. |

| FATCA-CRS annexure is mandatory for NRI’s irrespective of change in address. |

| Non DBT consent – applicable if Aadhar is provided as proof. |

Non English Language Declaration Form (If your documents are in foreign language other than English): Download

Source: HDFC Bank

Update Nomination Details in HDFC Bank Online

Customer Care Number: 18002026161

So, this is all about HDFC KYC Updation Online it.