Hi Everyone! How are you all? Hope everyone is fine and doing well. So, today we are here to discuss about State Bank of India auto-sweep facility. Auto sweep facility will help you to earn FD return from your saving/current accounts. Auto-sweep facility is a combination of saving account and a fixed deposit account. With this facility, you will get benefit of both saving and fixed deposits. In this case, saving account is linked with fixed deposit and a monetary limit is defined. Whenever the amount in the saving/current accounts exceed the defined limit, the extra amount is automatically transferred into the fixed deposit. So, in this way saving account balance can earn a higher interest rate. Hope you have understand the benefit of auto-sweep facility. Therefore, go through this How to Activate Auto Sweep Facility in SBI Account? post till the end and learn how to enable it.

Things Required

Saving/Current Account

Net Banking Facility

You can enable this facility online

How to Activate SBI Auto-Sweep Facility Using Net Banking?

If you are having online banking facility then you don’t need to visit branch for it. Just follow below steps and enable from anywhere

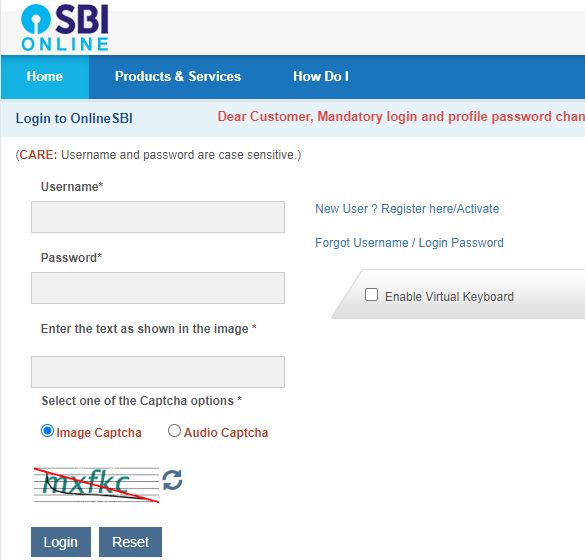

- First of all, login to your SBI online banking account. SBI Online Banking

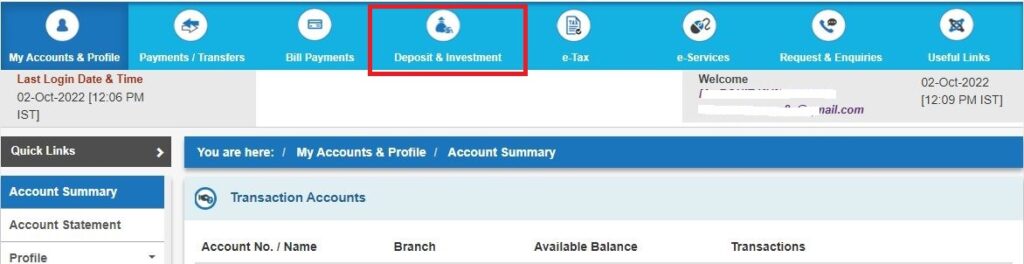

- Once login, go to “Deposit & Investment” option and then click on “Deposit“

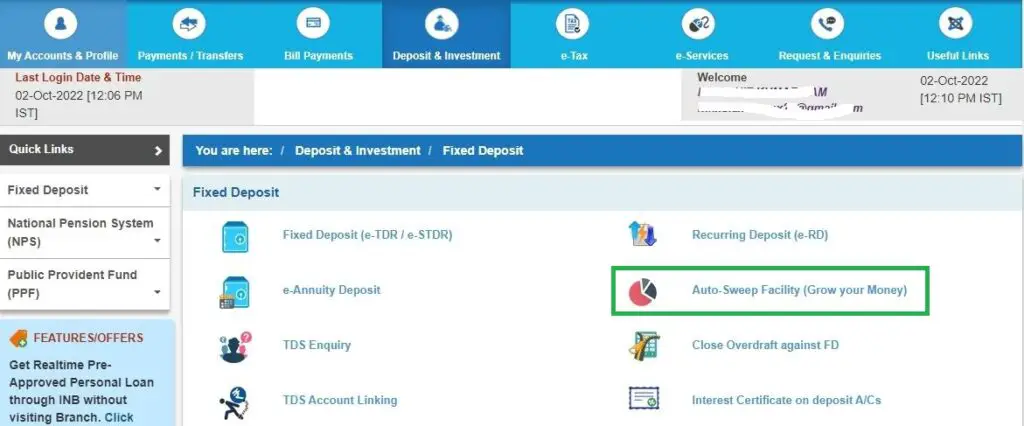

- Now, you can view “Auto-Sweep Facility (Grow your Money)” option, click on it to proceed.

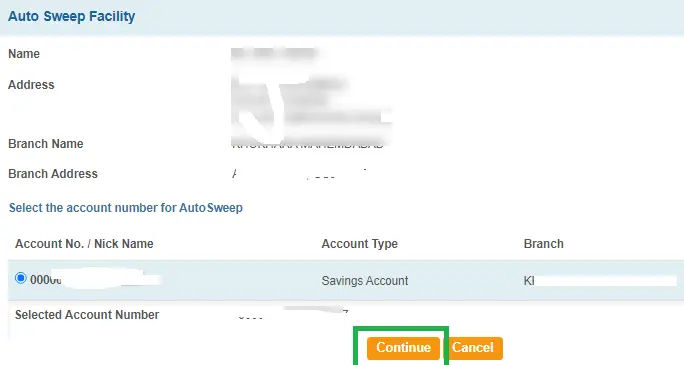

- Now, select the account on which you want to enable the auto-sweep facility. Click on Continue

- Enter the required details such as threshold amount, duration etc.

- Finally, enter the OTP to submit the request

In this way, you have enabled the sweep facility in your saving account. Please note that saving account must have above Rs 25000 account balance for activating this facility. It will help you to earn higher interest rate instead of a saving account interest rate.

Activate Via SBI Yono App

So, follow below steps:

- First of all open SBI Yono app on your smartphone

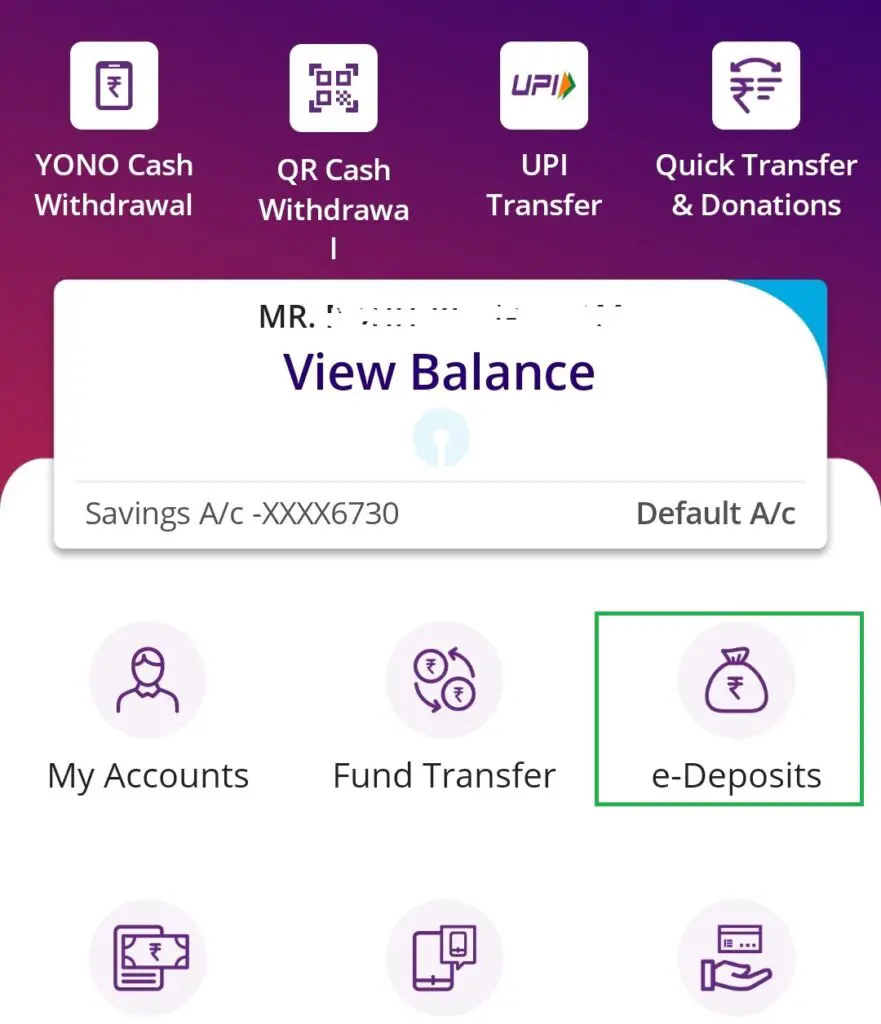

- Go to e-Deposits

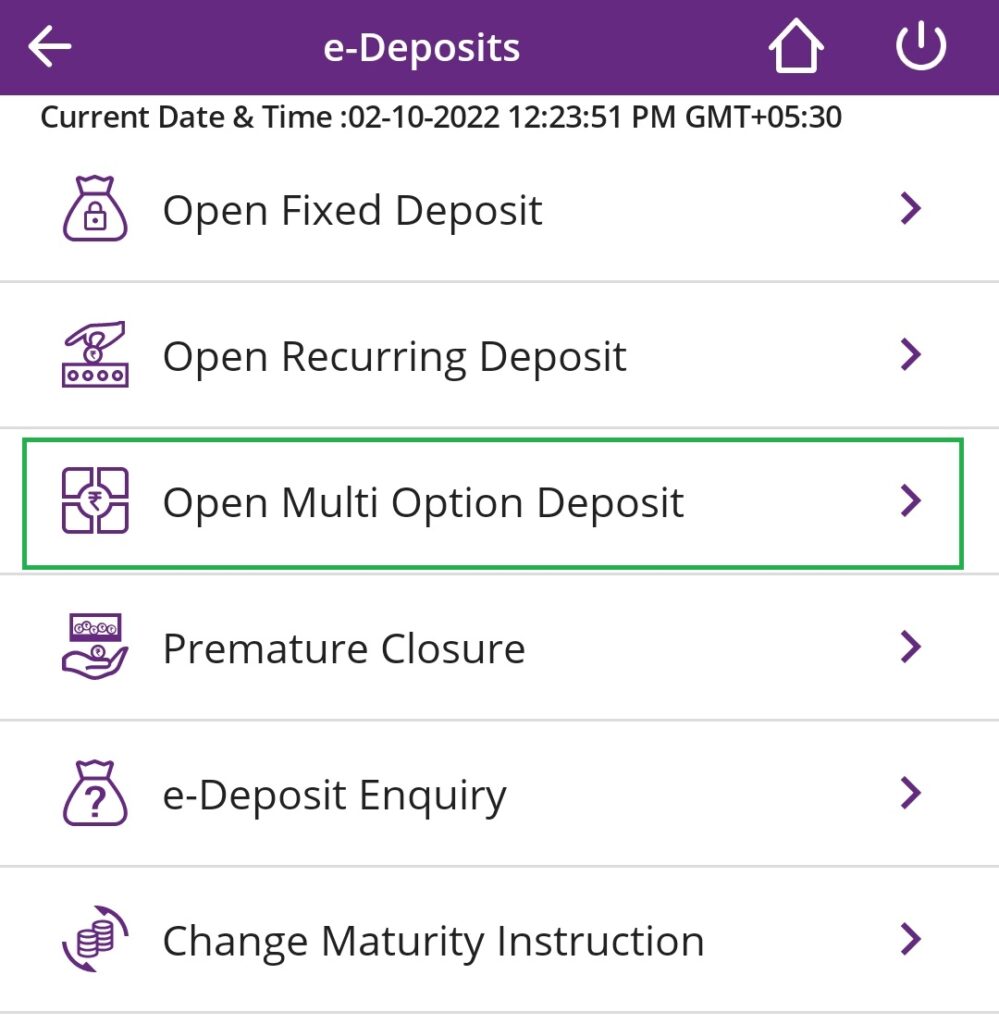

- Now, click on Open Multi Option Deposit

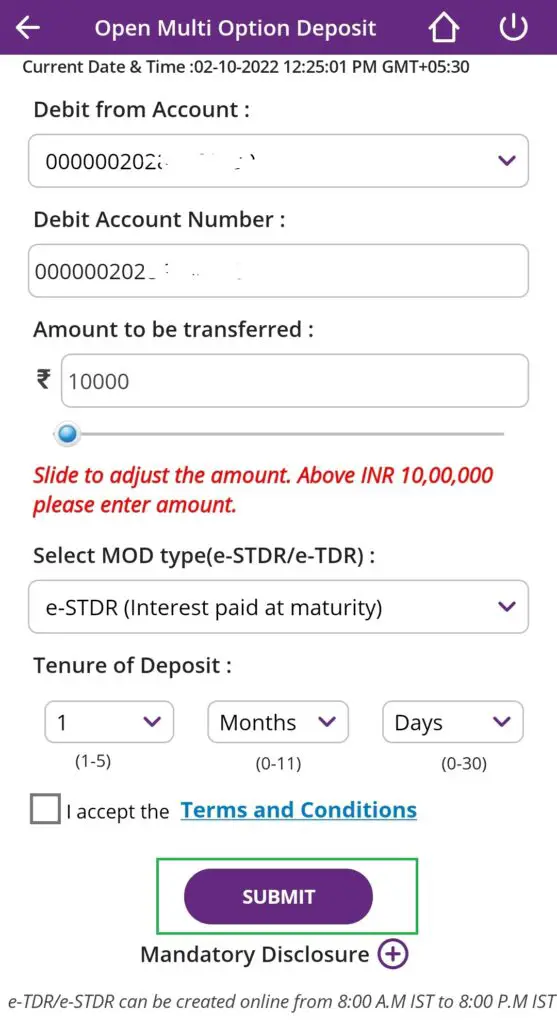

- Next, fill the details according to your requirement

- After filling all the details click on Submit

Transfer SBI CIF Number from One Branch to Another

Features

- These are combination of Term Deposits/Special Term Deposits with linked Savings Bank/ Current Accounts.

- Deposits are completely liquid and can be withdrawn in multiples of Rs. 1000, any number of times through cheque/ATMs/INB.

- Tenor of deposits for 1 to 5 years.

- TDS is applicable at prevalent rate.

- Nomination facility is available.

- Provision of MODs are also available through auto sweep facility in Savings Plus accounts.

- For ‘auto sweep’ facility, the Minimum Threshold Balance & Minimum Resultant Balance should be Rs 35,000/-and Rs. 25,000/- respectively. inimum Sweep amount of Rs. 10,000/- in multiples of Rs.1000/-.

- It is to be noted that the above restriction on Threshold Limit will apply only for availing auto sweep facility and the individual Stand – Alone MOD an continue to be opened by the customers including e-MOD with a minimum of Rs.10,000/- irrespective of the Threshold Level. Additional Rate of interest applicable to Senior Citizens is payable.

- Maintaining AMB (Average Monthly Balance) is applicable on linked Savings Bank/Current Account.

Source: SBI MOD

Customer Care Helpline Number: 18001234

Set SBI ATM Card Limit/Channel/Usage

Frequently Asked Questions (FAQs)

What is auto-sweep in SBI?

Auto-sweep is facility in SBI which helps to earn higher interest rate for saving/current accounts

How to activate auto-sweep facility?

Please use above steps

Can I enable online?

Yes

Can I activate via SBI Yono app?

Yes, check above steps

My saving account is not visible?

If your account is not visible that means you are not eligible. Your account balance may be below Rs 25000

What interest rate I will earn?

FD interest rate

What minimum balance required to enable this facility?

Rs 25000

Add Standing Instructions (SI) in SBI Online

I have a query other than above?

Please talk to SBI customer care at 18001234

So, this is all about How to Activate Auto Sweep Facility in SBI Account?

Thanks for staying with us till the end. Share about us among your friends and relatives

Have a great day!