Hello Everyone. So, today we will be guiding you how to do international fund transfer from SBI account. The process has now become easy. We will be discussing complete details about foreign fund transfer. State Bank of India has recently started Foreign Outward Remittance Transfer. As usual, first you have to add beneficiary before initiating fund transfer. Maximum upto 10 lacs can be transferred. Supported currencies are- USD, EUR, GBP, SGD and AUD. Therefore, go through the complete post to know in details: How to Transfer Money From SBI to Foreign Bank Account?

Add Standing Instructions (SI) in SBI Online

How to Transfer Money From SBI to Foreign Bank Account?

So, follow below steps:

- First of all visit SBI net banking login page. Click Here

- Login to your account with your username and password.

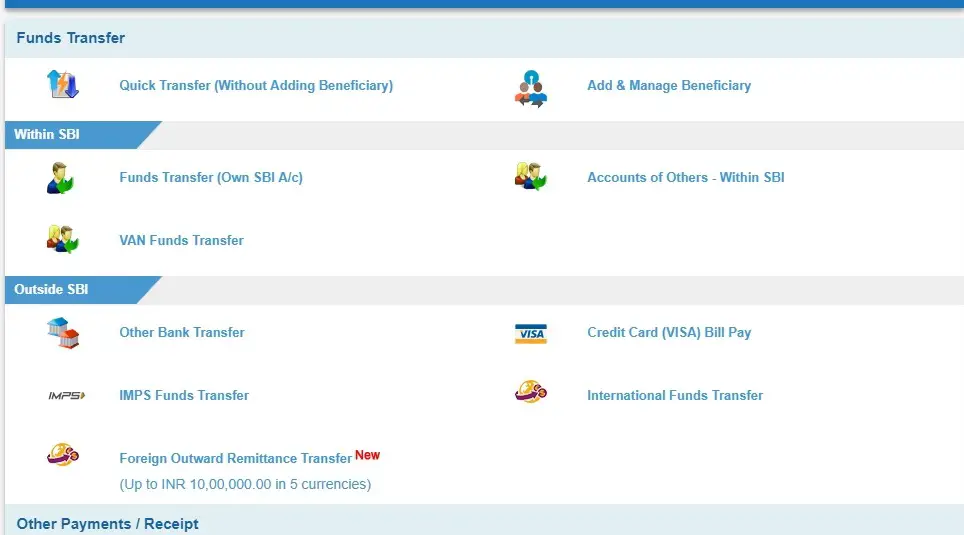

- Next, go to “Payments/Transfers“.

- So, click on “Foreign Outward Remittance Transfer“

- Click on “Resident Indian” link.

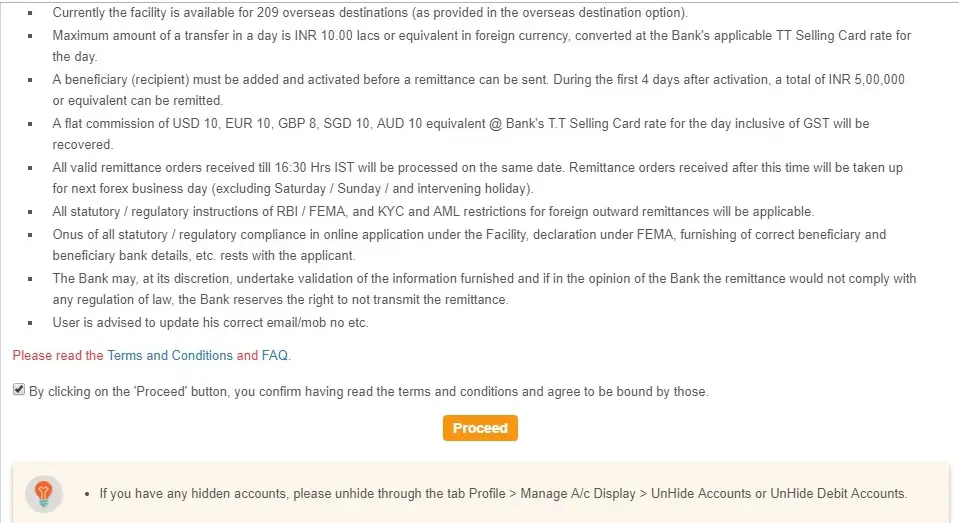

- Now, tick mark the check box and click on “Proceed“

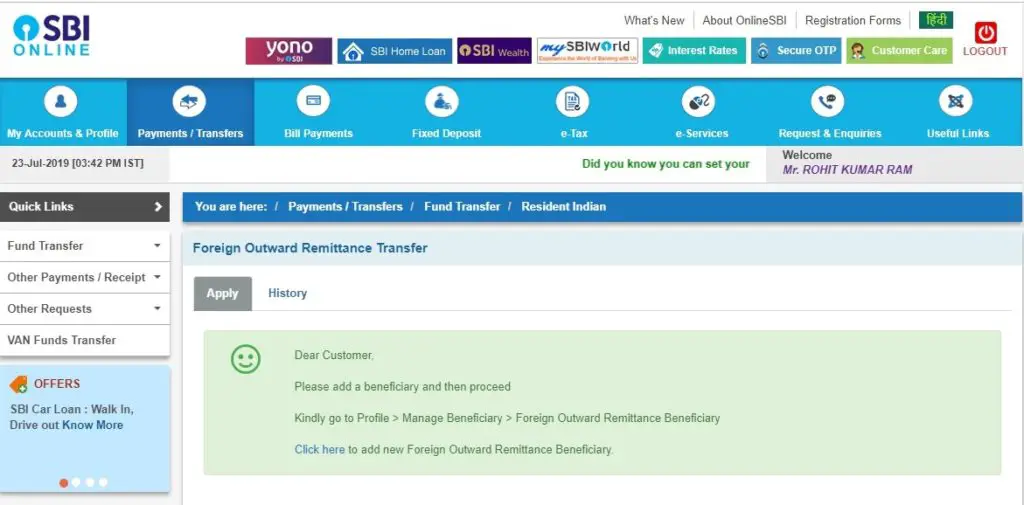

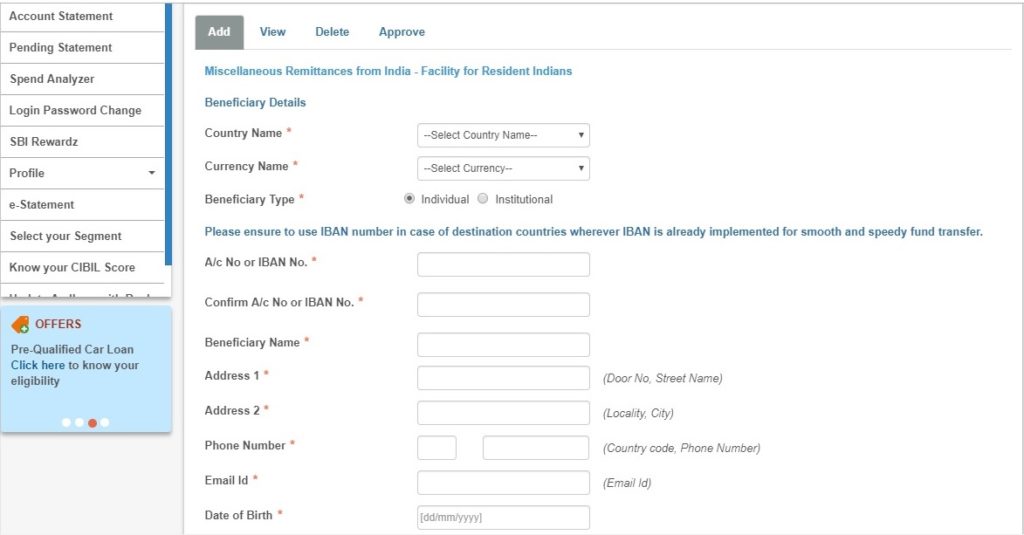

- First you need to add beneficiary. Click on “Click Here” to add new foreign outward remittance beneficiary.

- Enter your profile password and click on “Submit“.

- Therefore, a form will open. Fill all the details carefully and click on “Register“.

- Next you will receive one time password for self approval.

- Finally, transfer can be made after 4 hours.

Note: New beneficiary will be active within 4 hours.

Maximum Amount that can be transfer: Rs 10 Lac

Facility Available in Currency: USD, EUR, GBP, SGD & AUD

Apply for a New SBI ATM Card to Your Present Address Online

How to Approve Beneficiary for International Transfer From SBI to Foreign Bank Account?

So, follow below steps:

- First of all visit SBI net banking login page. Click Here

- Login to your account with your username and password.

- Next, go to “Payments/Transfers“.

- So, click on “Foreign Outward Remittance Transfer“

- Click on “Resident Indian” link.

- Now, tick mark the check box and click on “Proceed“

- First you need to add beneficiary. Click on “Click Here” to add new foreign outward remittance beneficiary.

- Click on “Approve“.

- Enter your profile password and click on “Submit“.

- Finally, you can see the recently added beneficiary for approval.

Apply for PPF Account in SBI Online

Frequently Asked Questions (FAQ)

Can I transfer fund without adding beneficiary?

No

So, what is the maximum amount that I can transfer?

Rs 10 Lac

Currency where transfer can be made?

USD, EUR, GBP, SGD & AUD

What is the commission?

A flat commission of USD 10, EUR 10, GBP 8, SGD 10, AUD 10

My transaction got failed?

If transaction gets rejected due to technical problem, no amount will be debited.

I want to request new cheque book?

To do so, click here: How to Request New Cheque Book in SBI Online?

So, I have a query other than above?

Talk to customer care at 1800 425 3800

SBI Helpline: 1800 425 3800

Still any Doubt? Don’t hesitate, feel free to ask anything. We are always happy to help you.

Please comment below, if you have any question.

Keep Visiting: Jugaruinfo

While completing the on-line form, after entering Beneficiary (activated), country amount, charge to remitter etc , what to enter in these two mandatory fields that offer NEITHER options NOR helpful suggestions? “Remittance Instructions” and “Remarks” .

The form shows “equivalent amount in INR 356250” i.e. [email protected] (TT card rate) but can you guide as to OTHER charges, taxes etc i.e. total debited to account will be Rs.356250 plus what?

Hello Chowdhury

Remittance Instructions and Remarks is optional.

About other charges, please talk to SBI customer care once.

Thanks

What is GIC and Non-GIC means, when do we have to sielect GIC/Non-GIC?

Hi Hari,

Non-Redeemable GICs are available for periods ranging from 6 months to 5 years. Non-Redeemable GICs may not be redeemed before maturity. If the GIC is for a term of less than one year, simple rate of interest calculated on the entire term of the investment shall be paid.

Source: Google