Hi Everyone. Hope everyone is fine and doing well. Today we are here to discuss about Standing Instructions in HDFC bank. With SI, you can transfer an amount to any account on monthly, yearly basis. This is very useful especially in accounts such as PPF, SSA. It becomes very difficult for anyone to remember and deposit amount every month. Due to this, sometimes our account also stops due to premium lapse. It is an one time time process and very easy. You can also modify or delete whenever you feel so. We will be explaining how to start SI in PPF, SSA accounts with the help of net banking. After going through it, you can easily do. So, stay tune with How to Add SI in HDFC Bank Online? post till the end to know in details.

How to Add Standing Instructions in PPF Account?

Path: Login to HDFC Net Banking>Accounts>Transact>Fund Transfer to own Accounts>Request Standing Instructions to PPF or Sukanya Samriddhi Yojana Accounts

We have explained below with the help of HDFC net banking. So, follow below steps:

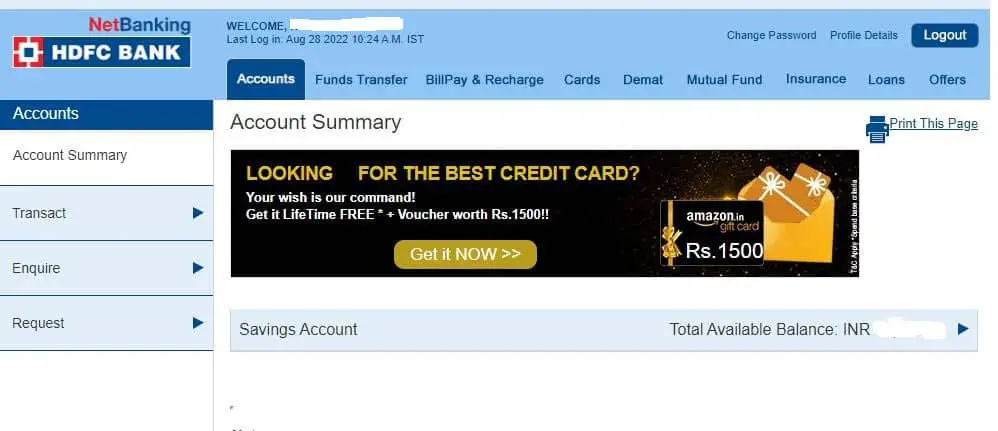

- First of all login to your HDFC net banking account. HDFC NetBanking

- Once login, your net banking account dashboard will open.

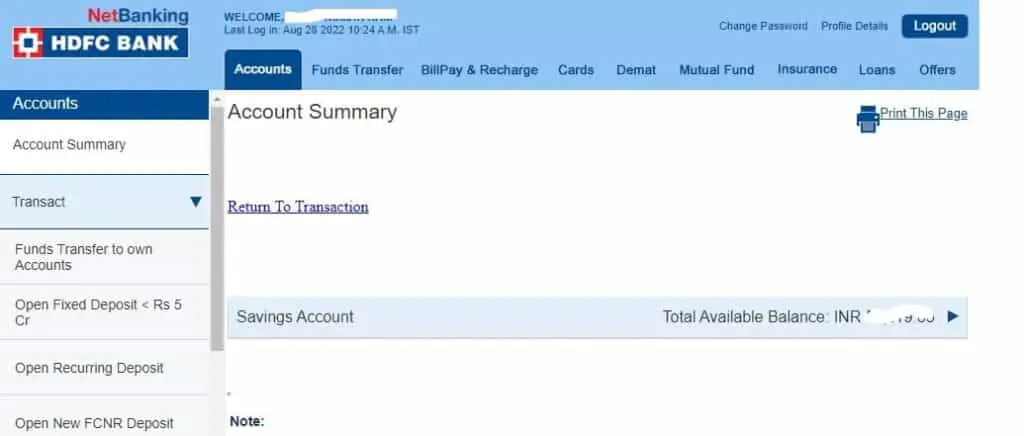

- Now, go to Accounts section and then click on Transact option.

- After that click on Fund Transfer to own Accounts

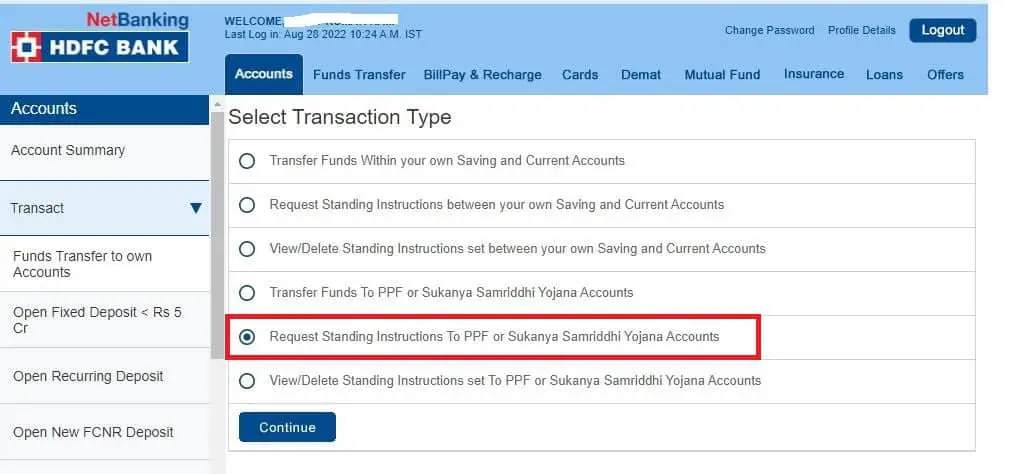

- You can now see different types of Transaction Type. Select Request Standing Instructions to PPF or Sukanya Samriddhi Yojana Accounts from below options. Click on Continue

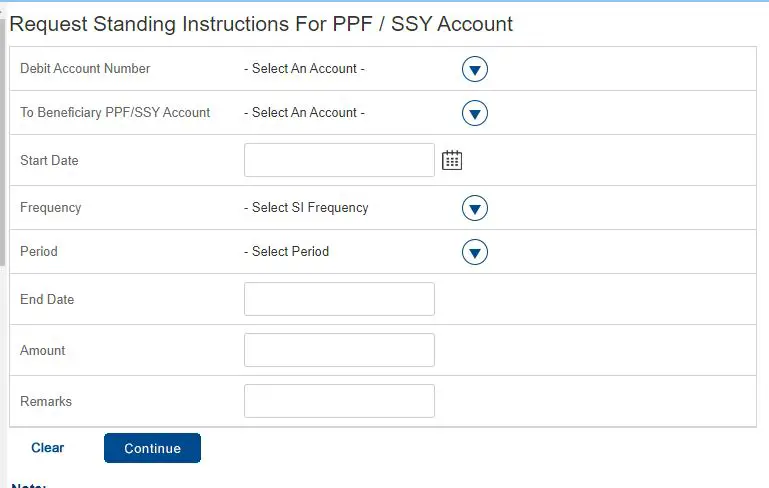

- Select your account first then your PPF account

- Select Start Date from when you want to start the SI. Every month on this particular date, amount will be deducted. Next, select Frequency as monthly or yearly.

- In Period, if you want to continue this SI for a year then select 12 and for 5 years select 60 i.e., in the multiples of 12.

- Enter the amount you want to deposit every month or year. Please note that for PPF minimum deposit is Rs 500 in a financial year. Maximum deposit Rs 1.5 Lakh per year

- Once selecting all the option. Click on Continue to proceed.

- After submitting, SI will be effective and amount will be deducted automatically every month on selected date.

Please note you can anytime modify or delete your Public Provident Fund SI. So, no need to worry.

How to Upgrade HDFC Debit Card Online?

Request SI in HDFC SSA Account

We have explained below with the help of HDFC net banking. So, follow below steps:

- First of all login to your HDFC net banking account.

- Once login, your net banking dashboard will open.

- Now, go to Accounts section and then click on Transact option.

- After that click on Fund Transfer to own Accounts

- You can now see different types of Transaction Type. Select Request Standing Instructions to PPF or Sukanya Samriddhi Yojana Accounts from below options. Click on Continue

- Select your account first then your SSA account

- Select Start Date from when you want to start the SI. Every month on this particular date, amount will be deducted. Next, select Frequency as monthly or yearly.

- In Period, if you want to continue this SI for a year then select 12 and for 5 years select 60 i.e., in the multiples of 12.

- Enter the amount you want to deposit every month or year. Please note that for SSA minimum deposit is Rs 250 in a financial year. Maximum deposit Rs 1.5 Lakh per year

- Once selecting all the option. Click on Continue to proceed

- SI will be effective from the selected date and the amount will be deducted automatically.

Please note you can anytime modify or delete your SSA SI. So, no need to worry.

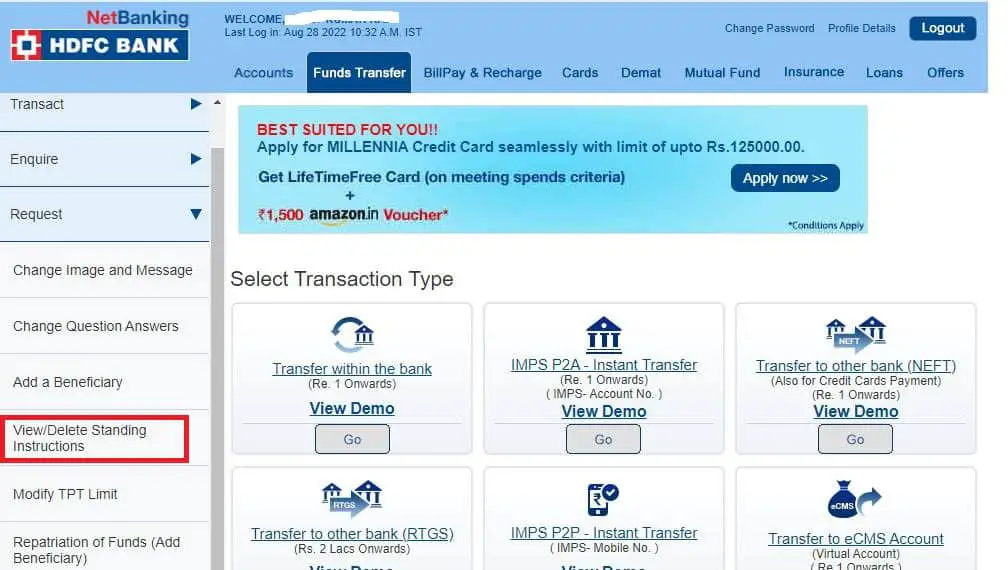

How to View or Delete SI in HDFC Bank Online?

Path: Login to HDFC NetBanking>Fund Transfer>Request>View/Delete Standing Instructions>Select and then Delete

So, follow below steps:

- First of all login to net banking account.

- Next, go to Fund Transfer menu and then Request tab.

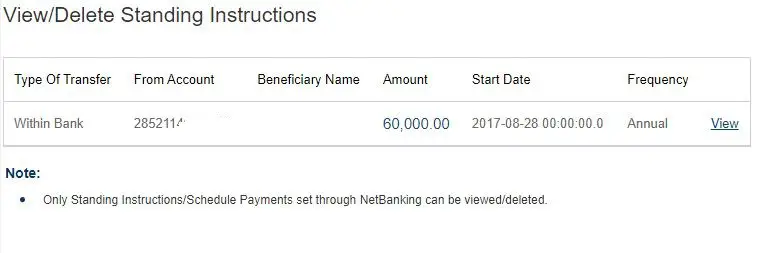

- Now, click on View/Delete Standing Instructions. You can view all the SI started through net banking.

- Select which you want to delete. In this way, you can delete or stop SI in HDFC bank online.

Frequently Asked Questions (FAQs)

Can I view all my SI?

All the SI started through net banking can be viewed

How to Start SI in PPF account?

Follow above steps

Can I also request SI in SSA account?

Yes. Only requirement is that your SSA account must be linked with your HDFC account

I want to delete my SI?

Follow above steps.

So, this is all about How to Add SI in HDFC Bank Online? it.

If you have found this post useful, kindly share about Jugaruinfo among your friends and relatives.

Thanks for staying with us till the end of this post.