Hello Everyone. How are you all? Hope everyone is fine and doing well. So, today we are here to guide you about how to add SI in your SBI account online. If you have PPF, SSA or any other account, you can add SI to it and fund will be transfer automatically. SI can also be set to individual beneficiary. It is a new facility introduced by State Bank of India. This can be done with the help of net banking. We will be explaining the things in very simple and easy way. Frequently Asked Questions section is also added, don’t forget to read. Therefore, go through the complete post to know in details: Add Standing Instructions (SI) in SBI Online

How to View or Cancel Standing Instruction for PPF in SBI Online

What is Standing Instructions?

The Standing Instructions feature facilitates periodic scheduled payments for funds transfer, third party payment, and RTGS/NEFT/State Bank Group transactions. Read more about SI here

How to Add Standing Instructions (SI) in SBI Online?

Through SBI Yono App

So, follow below steps:

- First of all open SBI Yono app.

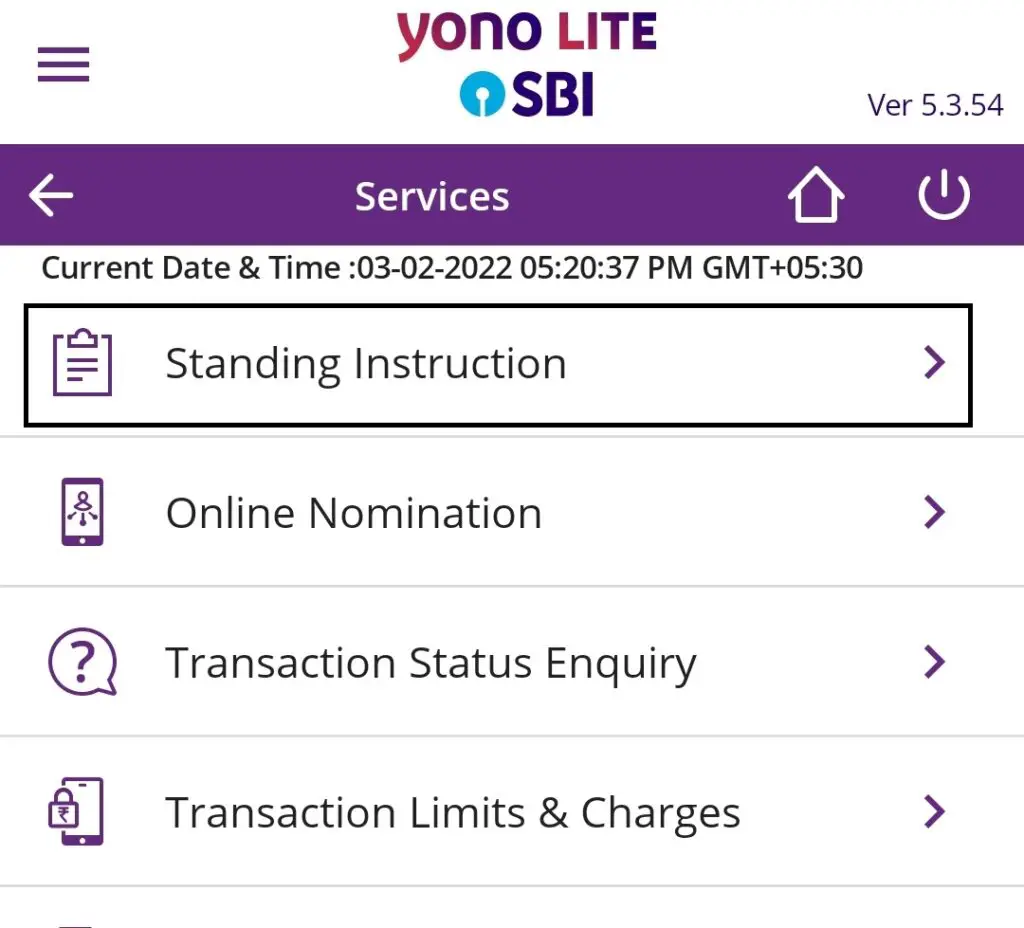

- Next, go to Services menu and then click Standing Instruction

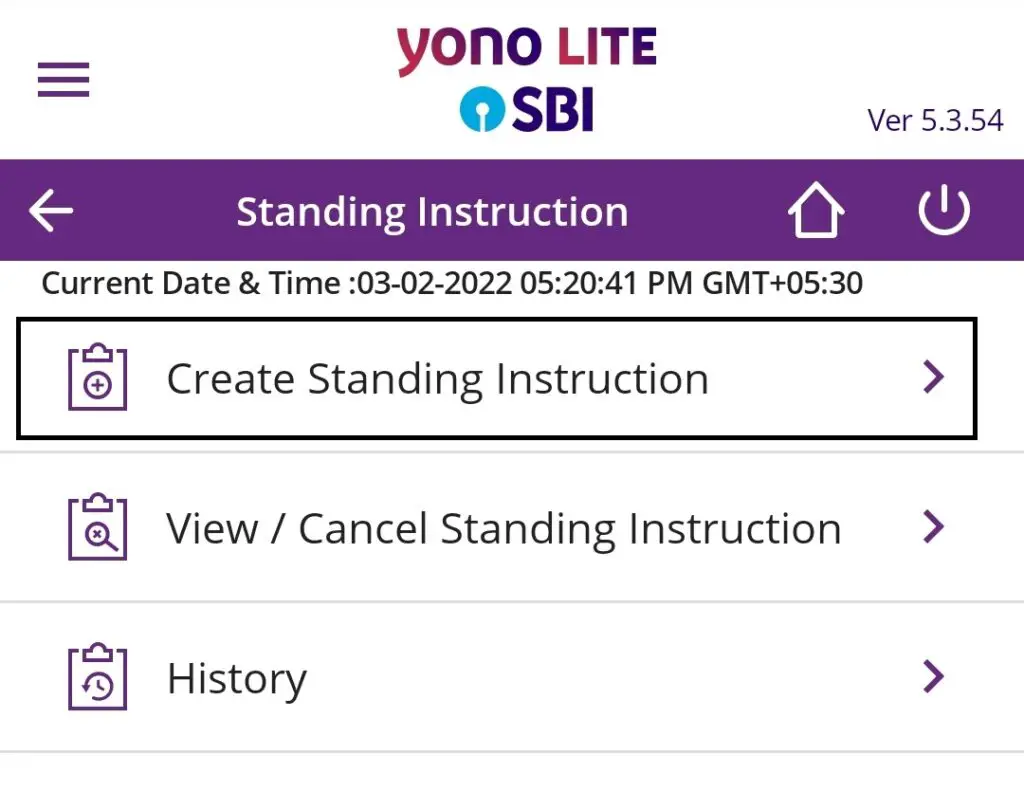

- Now, select Create Standing Instruction option.

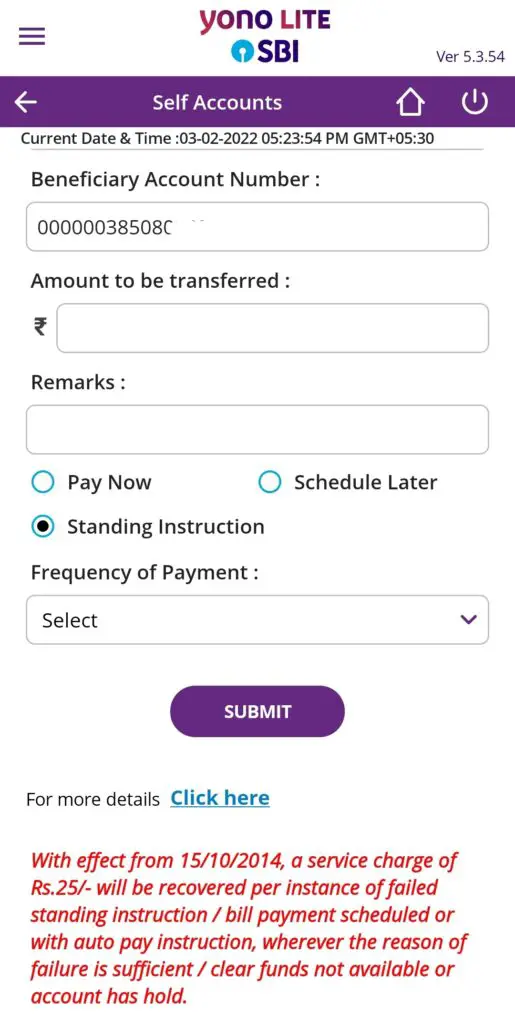

- You need to select now type of instructions. That means whether it is for self account, other SBI accounts or other bank accounts.

- Select Credit Account from the drop down. Amount to be transferred, frequency and then click Submit button to complete.

- In this way, SI is set.

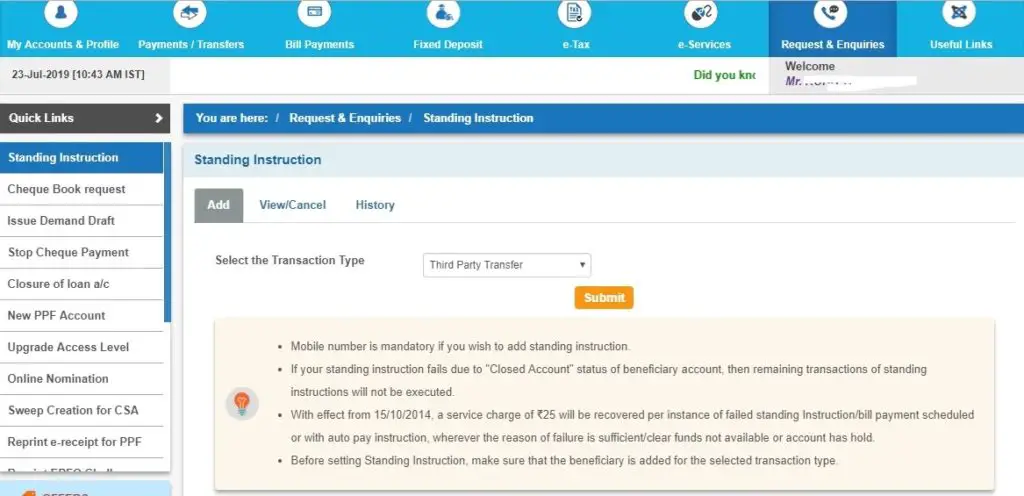

Note: With effective from 15/10/2014, a service charge of Rs 25/- will be recovered per instance of failed standing instruction/bill payment scheduled.

How to Activate Auto Sweep Facility in SBI Account?

Through SBI Net Banking

So, follow below steps:

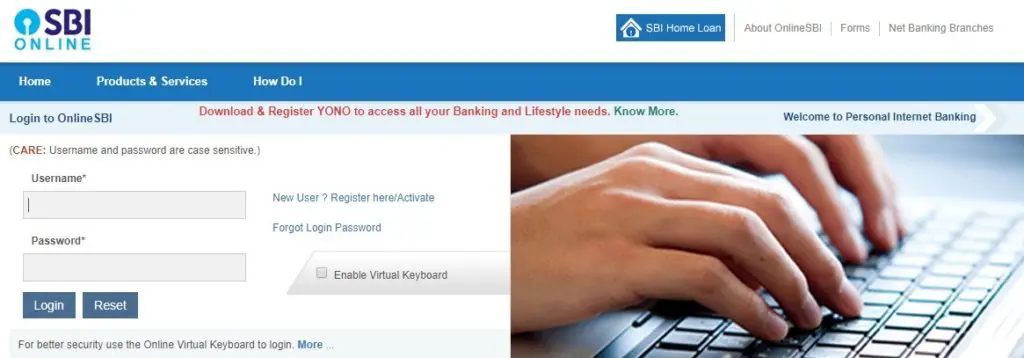

- First of all visit SBI net banking login page. Click Here

- Login to your account with your username and password.

- Therefore, your net banking account will open. Go to “Request & Enquiries” option.

- Click on “Standing Instructions“

- Now, select the transactions type and click on “Submit“.

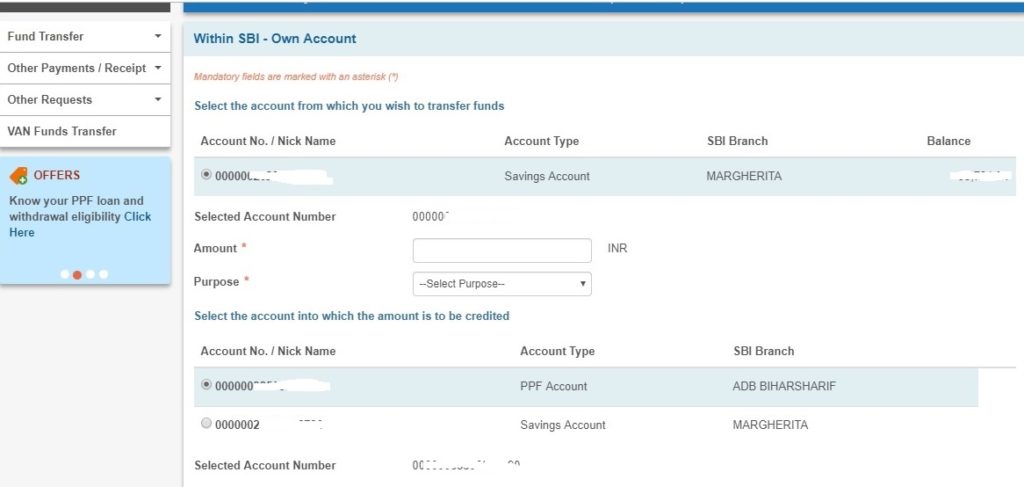

- So, a form will open. Enter amount, purpose, account, frequency etc and click on “Submit“.

- Finally, you have added SI.

How to View/Cancel Standing Instructions (SI) in SBI Online?

So, follow below steps:

- First of all visit SBI net banking login page. Click Here

- Login to your account with your username and password.

- Therefore, your net banking account will open. Go to “Request & Enquiries” option.

- Click on “Standing Instructions“

- So, click on “View/Cancel” option.

- Select the type of transactions and click “Go“.

- Finally, you can view or cancel SI in SBI onlibe.

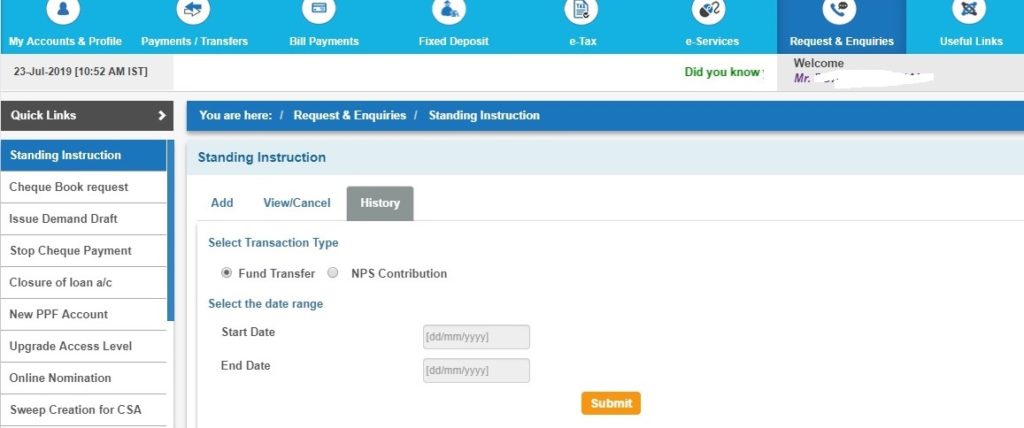

How to Check History of Standing Instructions (SI) in SBI Online?

So, follow below steps:

- First of all visit SBI net banking login page. Click Here

- Login to your account with your username and password.

- Therefore, your net banking account will open. Go to “Request & Enquiries” option.

- Click on “Standing Instructions“

- So, click on “History” option.

- Select the date range and hit “Submit” button.

- Finally you can see history.

How to View Last Five Standing Instructions (SI) in SBI Online?

So, follow below steps:

- First of all visit SBI net banking login page. Click Here

- Login to your account with your username and password.

- Therefore, net banking account will open. Go to “Request & Enquiries” option.

- So, click on “Standing Instructions“

- Now, select the transactions type and click on “Submit“.

- A form will open. Finally, click on “View Last Five Standing Instructions Transactions “

How to Add PPF Standing Instructions (SI) in SBI Online?

So, follow below steps:

- First of all visit SBI net banking login page. Click Here

- Login to your account with your username and password.

- Therefore, your net banking account will open. Go to “Request & Enquiries” option.

- Click on “Standing Instructions“

- Now, select the transactions type and click on “Submit“.

- So, a form will open. Enter amount, purpose, PPF Account, frequency etc and click on “Submit“. Don’t forget to select “PPF Account“

- Finally, you can add PPF SI in SBI.

How to Add SI in SBI for NEFT/RTGS?

So, you can follow above process.

Open a PPF account in SBI: Apply for PPF Account in SBI Online

State Bank of India Toll Free Number: 1800 425 3800

Watch Video on this: View

Frequently Asked Questions (FAQ)

Can I add SI in SBI online?

Yes

Can I set SI through SBI Yono?

Yes

What is the frequency for which I can register SI?

You can register SI for 1 month to 6 months and from 5 days to 30 days.

Do I need to login every month for approving SI?

No

Can I register multiple SI?

Yes, you can register multiple Standing Instructions on different accounts and at different frequencies

Will I be intimated after SI execution?

Yes

I want to change my mobile number?

So, get here complete details: Change Mobile Number Online in SBI Without Visiting Branch

Can I add SI through ATM?

No

Do I need to visit branch for cancelling SI?

No. Cancellation process is given above.

I don’t have net banking, how to add SI?

Net banking is must. Therefore, you have to visit bank branch for it.

Will the bank intimate me when a standing instruction is executed successfully?

You will receive an SMS when a standing instruction is executed and your account is debited.

I want to apply ATM in my present address?

Yes, you can. So, follow this guide: Apply for a New SBI ATM Card to Your Present Address Online

So, Standing Instructions can be used in?

Fund transfer, third party payment, RTGS/NEFT etc.

Is it safe to start SI?

Yes

Can I cancel a Standing Instruction?

Yes, you can cancel standing instructions, if at least one instruction is pending for execution. However, you cannot cancel a standing instruction if it is scheduled for the current date

What are the accounts on which I can register Standing Instructions?

You can register Standing Instructions on your saving and current accounts.

I have a query other than above?

Talk to SBI customer care at 1800 425 3800

Summary

Well, I have explain step by step process to start SI in SBI bank. Probably, you have also found it easier and simple. You can create SI though SBI Yono app and also with net banking. With the help of Standing Instructions, many of your banking stuffs becomes simple. You don’t need to remember payment date or due. You can start SI in PPF, FD/RD, SSA accounts etc. This is one time process and it starts deducting money in uniform way every month. You can also stop anytime you want. So, my personal suggestion will be you to start SI if you have any such accounts. Moreover, it is very difficult to remember every thing now a days. Stay safe and be happy.

Still any Doubt? So, don’t hesitate, feel free to ask anything. We are always happy to help you.

Please comment below, if you have any question.

So, keep visiting: Jugaruinfo for more updates. Kindly share about it among your friends and relatives.

Have a great day!

On your request so has been set.up.in account if not.requested please contact your.branch ka kiya MATLAB hota hai.shri man Ji

Hi Ghanshyam,

There may be some technical issue.